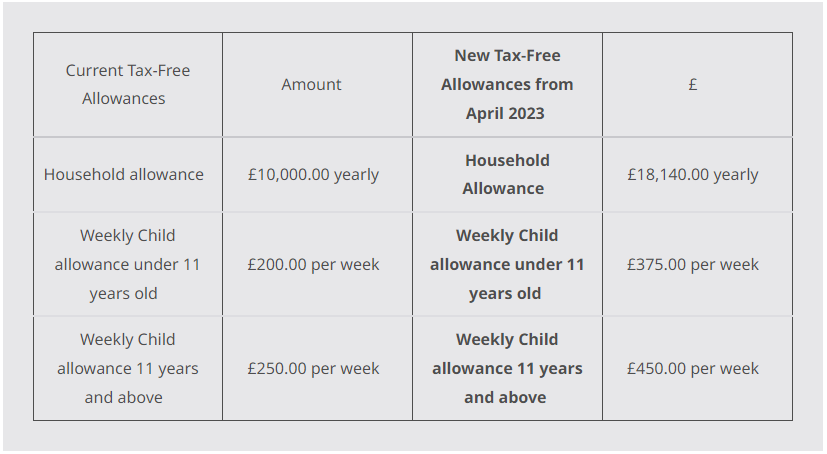

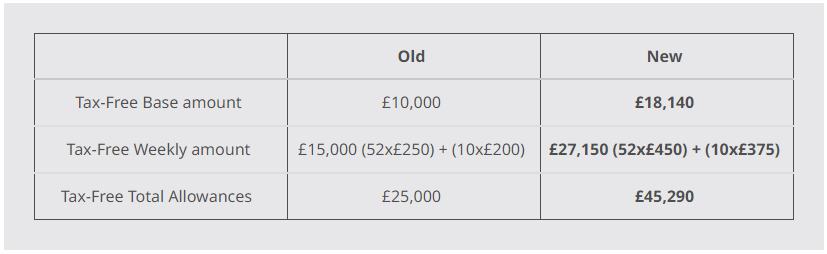

One of the more positive highlights of the recent 2023 Spring budget is that further tax breaks will be available for foster carers as of April 2023. The very good news is that more money will be taken home by foster carers up and down the country and begin to ease the pressures they are facing from the higher cost of living. This blog outlines the new allowances with a working example of how this will benefit foster carers. Below is an example for Sally a foster carer who looked after a 14-year-old all year and an 8-year-old for 10 weeks during the year. These new allowances significantly increase the amount of paythat foster carers can receive without falling into the tax net. This allows more funds to be retained to meet cost of living increases and meeting the expenses of looking after Foster children.

Fair Ways has been advocating for these increases for some time through the Fairer Fostering Network, a group of fellow charities and Not For Profit Fostering agencies. While they do not fully meet the needs of carers, they go a long way to ensuring that Fostering remains financially viable and will opefully address the decline in Fostering Carers across the UK. All foster carers with Fair Ways get a paid membership to the Fostering Network who provide free services to foster carers, one of these services is tax and financial advice. To find out more about fostering with Fair Ways please email [email protected] Source: www.fairways.co Comments are closed.

|

News & JobsNews stories and job vacancies from our member agencies, the fostering sector and the world of child protection and safeguarding as a whole. Browse Categories

All

|

|

The Fairer Fostering Partnership

c/o TACT Fostering Innovation House PO Box 137 Blyth NE24 9FJ |

RSS Feed

RSS Feed